Trump’s tax returns — released by the House Committee — are the gift that keeps on giving.

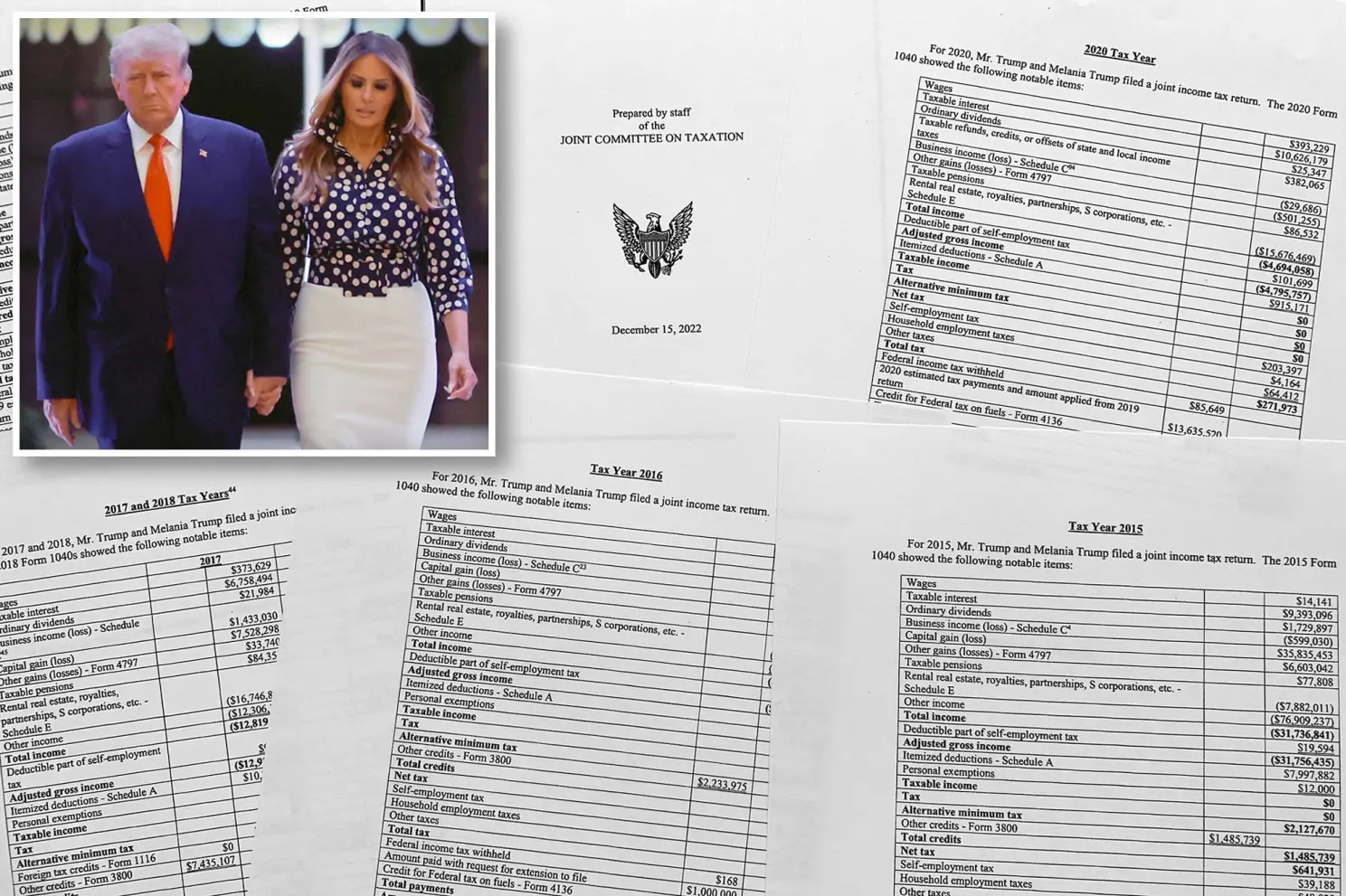

Not only did he not pay taxes for FOUR years, claiming negative income, but he also was not under audit when he used that as an excuse not to release his tax returns.

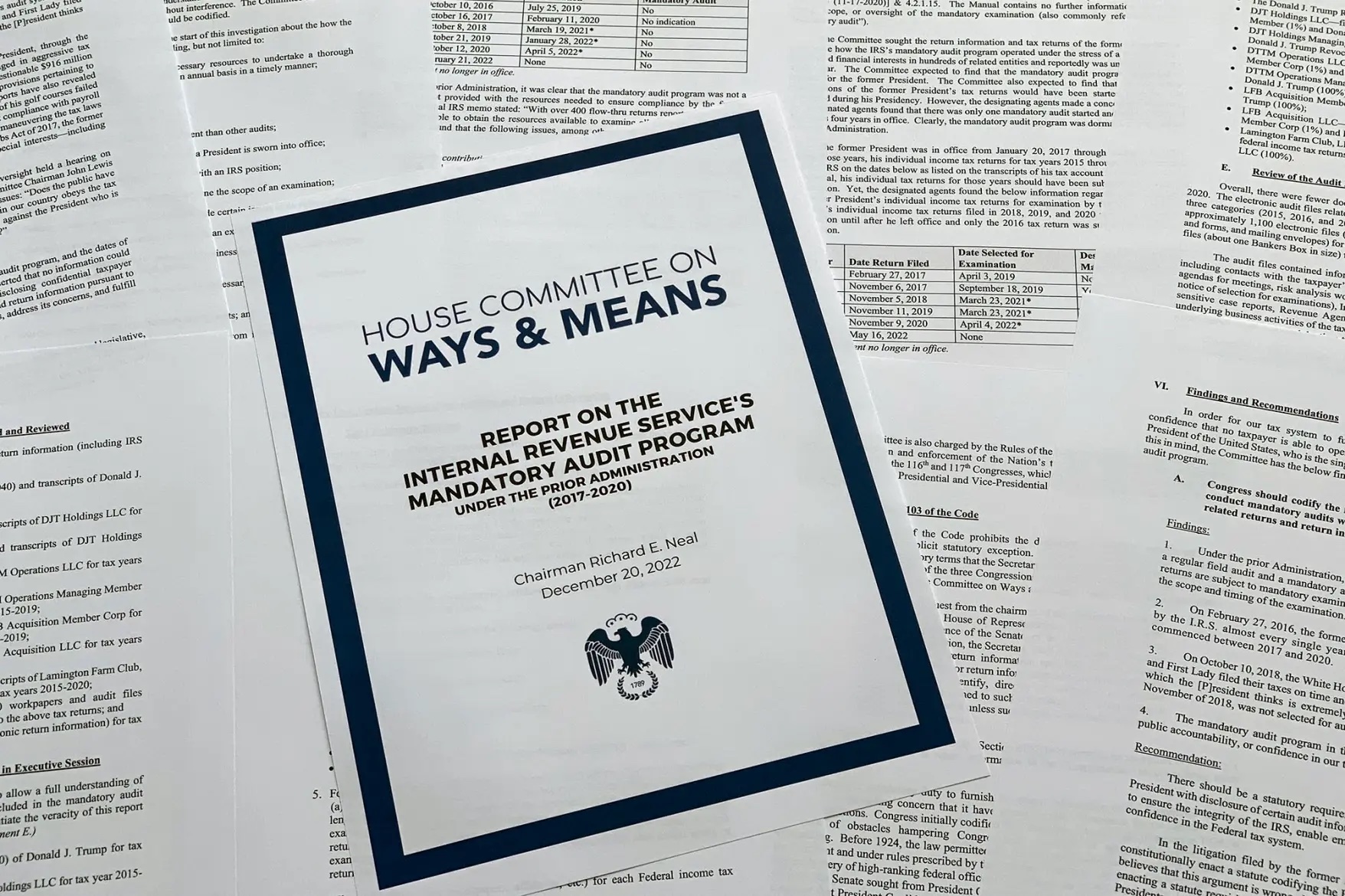

In fact, the IRS did not audit Trump as mandated, though they are scrambling to do that now. (Who did he pay off at the IRS?)

For instance, in 2015, Trump reported making more than $50 million through income in capital gains, interest, dividends and other earnings. But then he reported some $85 million in losses, leaving him at a negative income of $31 million.

The IRS is also examining some of Trump’s so-called business expenses and ‘party loans’ to Trump’s children Ivanka, Don. Jr. and Eric that he disguised as ‘gifts’ which made them not taxable.

There was one example where Trump was paid $50,000 for a speaking gig but claimed $46,162 in travel expenses.

‘Audits of closely-held entities often find personal expenditures being improperly deducted as travel expenses,’ the report said.

Democratic members of the committee said the release of the returns was necessary for transparency.

“I voted to reinforce this critical principle: No person is above the law, not even a president of the United States,” committee member Rep. Brendan Boyle (D-Pa.) said.