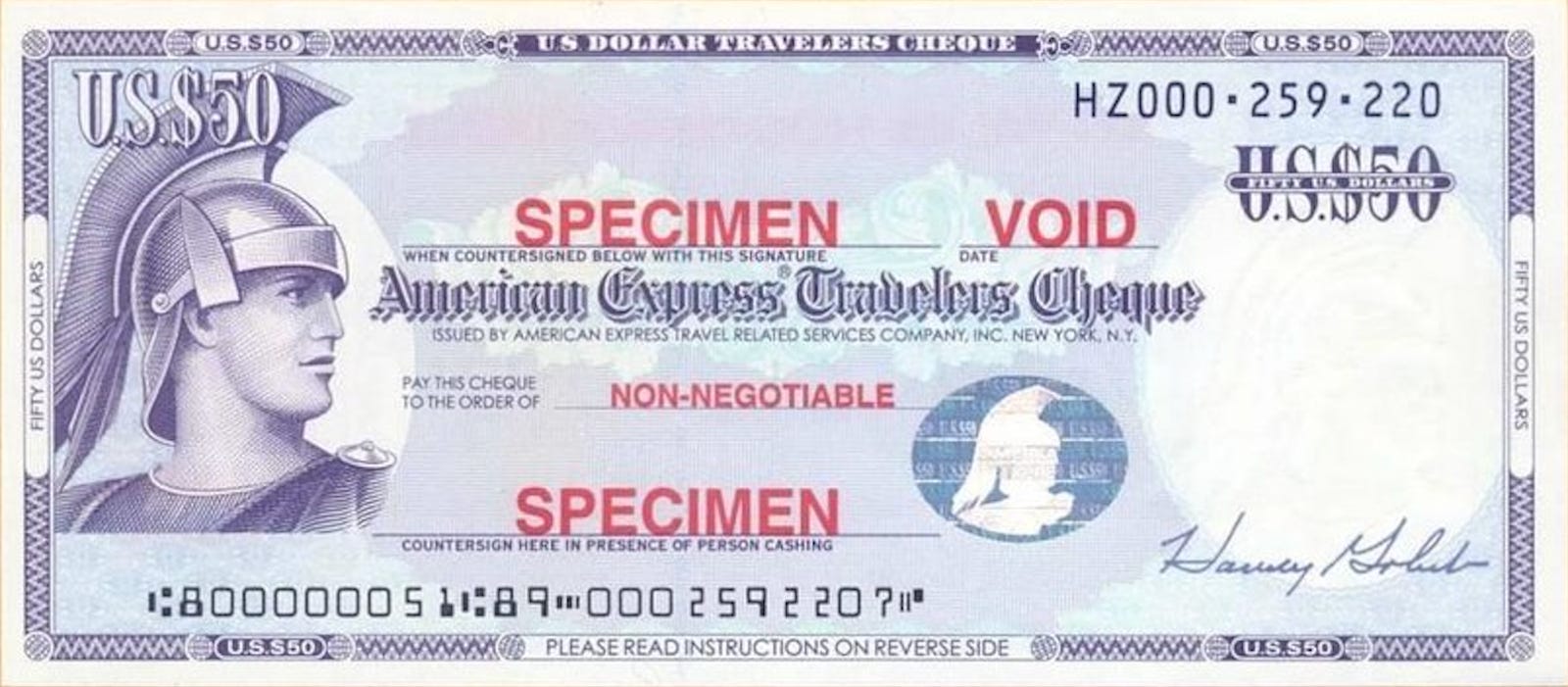

Back in the day, people actually used to take travelers’ checks with them when they went abroad (Google it, kids, it’s sooooo cute). Still, since the interweb, credit and debit cards, ATMs and all that jazz, those pain-in-the-ass things are thankfully a thing of the past unless you’re 85 years old and over.

But, what’s the best way to stop wasting travel money on unnecessary bank fees etc. and ensure you’re maximizing your precious Euros, Pesos, Riel etc. to spend on porn star martinis, VIP beachside cabanas, or free coloring books and crayons for local orphans (as if).

Here are a few tips on how not to waste travel funds on unnecessary bank fees and costs when traveling overseas.

NOTE: None of the following are anything to do with sponsored content because, well, that’s the devil. It’s based on my own experience and as I’m constantly broke, I’m clearly not raking it in from corporations ruining editorial by pretending to be content instead of adverts. On that note, I recommend you Google alternatives to any services I recommend, to see what the current best deal is and what works best for you depending on what country you’re visiting. (Oh, and I’m broke because I spend all the money I save on bank fees etc. on booze and ciggies).

-

The great ATM con

This may come as a shocker to any sweet, innocent lambs, or delusional Republicans who actually believe self-regulation of banks is a viable idea, because what could possibly go wrong, aside from banks being greedy money grabbing capitalistic bastards who will do all and everything to screw you out of your last penny—and they’ll do it in the sneakiest of ways….natch…because, banks. Anyway, when you use your bank card overseas at a foreign ATM they will go through all the usual malarky of entering your PIN number, how much money you want, selecting current, savings and credit account, etc. then usually before they inform you of the bank fees they’re charging (but sometimes after…. pay attention) they will offer you an exchange rate with the option to accept or decline it. DECLINE IT. ALWAYS.

People think it’s just standard bank procedure and if they decline it the transaction will end. IT’S NOT. It’s a higher exchange rate that banks offer initially because most people fall for it and they make extra $$$$. DECLINE IT. That way you’ll get a local exchange rate not a rip-off gringo one (and funnily enough the bank won’t tell you what the secondary exchange rate is, but yep, it’s way better). 99% of banks (the exception is sometimes credit unions, but they can have their moments too) pull this stunt and 99% of people fall for it. DON’T BE ONE OF THEM.

As it is they’ll charge you an arm and a leg in withdrawal fees–and that’s something you DO have to accept, sadly, so like I said pay attention to what you’re being asked. Most ATMs nowadays have the option of choosing English if you don’t speak the host language, but even if they don’t, it’s pretty easy to work out that they’re offering you an exchange rate. DECLINE. DECLINE. DECLINE.

-

ATM shop

ATM foreign withdrawal fees vary wildly. So, it’s worth checking out the fees of a few different ones before committing (if possible). Using Mexico as an example, BBVA charge $10 US per withdrawal. Yep really. $10 US, plus your own bank charges bank home. In contrast, BanCoppel is around $1.50 US depending on exchange rates. Big difference. Like, $10 US per withdrawal? Seriously?!! The Mexican national minimum wage is just over $15 US per day! Also, if you can avoid it, never use airport ATMs…. Just never, because, Ka-Ching! Finally, PAY ATTENTION! Some ATMS will give you cash first and then your card, others vice versa. Personally, I’ve taken cash and walked off without my card twice now, and it’s a major pain in the ass, seriously.

-

Go Local

If you’re paying for anything with your credit or debit card always insist on paying in the local currency. Most vendors should ask you, but if they don’t, then ask to pay in local. The local exchange rate is way better than the international one that financial institutions charge. So, yeah, always choose local.

-

Go International

This takes a tad of preplanning, like a week or so, but open an international account before jetting off. It’s an absolute godsend. Personally, I’ve always used WISE and I’ve always raved about them like a lunatic. But then, I moved to Colombia and they don’t offer a COP account, so now I kind of semi-hate them–but I still use them grudgingly, because they’re the best I’ve discovered for anything non-COP.

Within your main account, you can open different currency accounts, like MEX PESOS, USD, EURO, GBP, THAI BAHT etc. Then you can transfer money between the accounts accordingly at a really amazing exchange rate and, best of all, you can use your card to withdraw from the currency account of the country you’re traveling to and avoid all and any ludicrous exchange rates. Transfers between currencies are instant and best of all, I’ve never had WISE place a security hold on my account when overseas like annoying regular banks do.

-

Western Union es El Diablo

If you’re unfortunate enough to find yourself stuck somewhere without any access to cash, because you’ve lost your bank cards or left them in the ATM…. and you need an emergency cash injection, then SWERVE WESTERN UNION.

They are hands down the worst. Ever. Not only do they penalize developing world countries horrendously, but they are also a major headache, take forever to collect from, practice really unsavory and totally shady financial practices and charge extortionate exchange rates. They are the pitts. Period. Quick anecdote: My father tried to send me $100 US as an emergency to Acapulco. He paid WU for immediate clearance. I was told on the receiving end that they had to hold the $100 US for two working days because of “money laundering concerns.” Really?!!! Imagine how many millions of people they do that to worldwide on a daily basis and then calculate how much interest they make off those held funds. I’m crap at math, but it’s going to be a goddamn fortune.

Sadly, for Western Union, they didn’t bank on an 82-year-old British pensioner with nothing better to do with his time than spend FIVE hours on the phone going from “manager” to “manager” until he succeeded in demanding the money be released immediately–which they did.

“Why are you using Western Union to send money to your daughter?” They actually asked my dad at one point, as an example what an exemplary service they provide. “Great question,” he replied. “You might want to rethink your marketing tactic there.”

At some point during the fifth hour my dad ended up screaming down the phone (and he never screams or swears) “Who do you think I am, the Pablo Escobar of f****** Worcester? I’ve watched Breaking Bad [and he has, the entire series six times, word] and I’d be a pretty sh** drug baron if I was using Western Union to send $100 US to my daughter who has the same last name as me.”

‘Nough said. Use alternative services like Remitly, Revolut, XE or WorldRemit instead. For realz.