This just in: Thursday the House of Representatives passed the Republican plan to replace Obamacare by a vote of 217 to 213. Squeaking by with this close margin, Speaker Paul Ryan and President Trump crowed they had won a huge victory for the American people, but, not surprisingly, there are many dissenters.

Democrats blasted the bill, saying it would make insurance unaffordable for those who need it most and would leave millions more uninsured. They also accused Republicans of seeking tax cuts for the wealthy, paid for in part by cutting health benefits.

Here are the key measures in the House bill:

- Mandates: It guts the IRS requirement in Obamacare that people with purchase health insurance or face a fine.

- Tax credits: The bill replaces subsidies for people to purchase insurance in the individual market in the Affordable Care Act based on income with refundable tax credits based on age. The impact is that it will provide more people with assistance but with fewer dollars, especially for the older Americans.

- Medicaid: The Medicaid expansion is frozen immediately and in two years the states can start to adopt either a block grant for the program or a new formula based on population instead of need. In an attempt to make the bill more conservative, work requirements have been added for most able-bodied recipients who aren’t pregnant or caring for a child under 6.

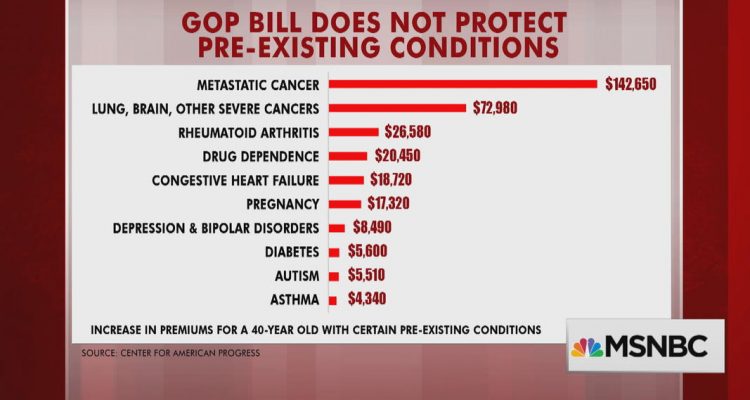

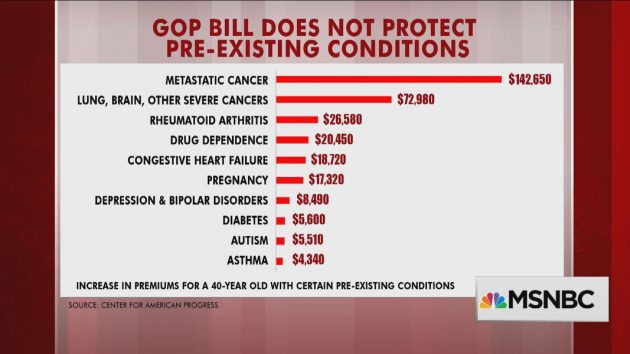

- High risk pools: The bill provides $130 billion to states over ten years for high risk insurance pools to cover the most expensive to insure. A new amendment by Rep. Fred Upton of Michigan adds an additional $8 billion to assist people with pre-existing conditions.

- State waivers: States can obtain waivers so insurers don’t have to offer robust benefits packages that include maternity care and mental health coverage. Waivers can also be obtained to charge sicker people and people with pre-existing conditions more. Those people would most likely then go into the high risk insurance pools.

- Taxes: It repeals every Obamacare tax including the .9 percent tax on couples making more than $250,000 and a 3.8 percent tax on investment income.

- Health Savings Accounts: The measure increases the allowable contribution limits of Health Savings Accounts

- Other: It keeps the Obamacare provision that people under the age of 26 can stay on their parents’ insurance.