Managing the finances is a difficult task. Tracking expenditures and keeping track of the bank balance can be daunting now that so many of us almost don’t balance a chequebook. Apps for personal finance can link to your bank account to enable you to keep track of your expenses, even help you manage future bill payments, monitor your credit score, and keep a record of your investment portfolio. All of the applications on our list are compatible with iOS and Android, allowing you to enjoy them regardless of which mobile you choose.

You Need a Budget – best for paying off debt

YNAB is a personal finance application based on the Four Rules of YNAB. The rules can help you not just create a healthier budget but also maintain leverage of your spending. To get an accurate view of your spending, import transfers from your checking account and add them to each budget group. When you unintentionally overspend, change spending types to maintain a balanced budget.

Mint – best overall app

Mint is among the most well-known apps because it brings together all of the financial information in one location. Mint pulls your transactions, categorises them, and tells you how you’re spending your money once you add your debit and credit cards to your account. You can maintain a record of your expenses and build a budget that you can adhere to. The platform offers free access to your credit score and a rundown of the variables that contribute to your score to help you keep on top of your credit health.

EveryDollar – most effective for budgeting

The app’s name, EveryDollar, comes from the zero-based budget, which gives every dollar a meaning in the budget. You can link to your bank and import transfers to keep track of your expenses with the built-in monthly expense tracker and communicate with money management specialists. You can also divide expenditures among several expenditure categories. The dashboard tells you how far you’ve invested so far this month and how much you still have left. If you have a load of money left and have a knack for casino games, you can very well Play Online Slots at Winissimo.

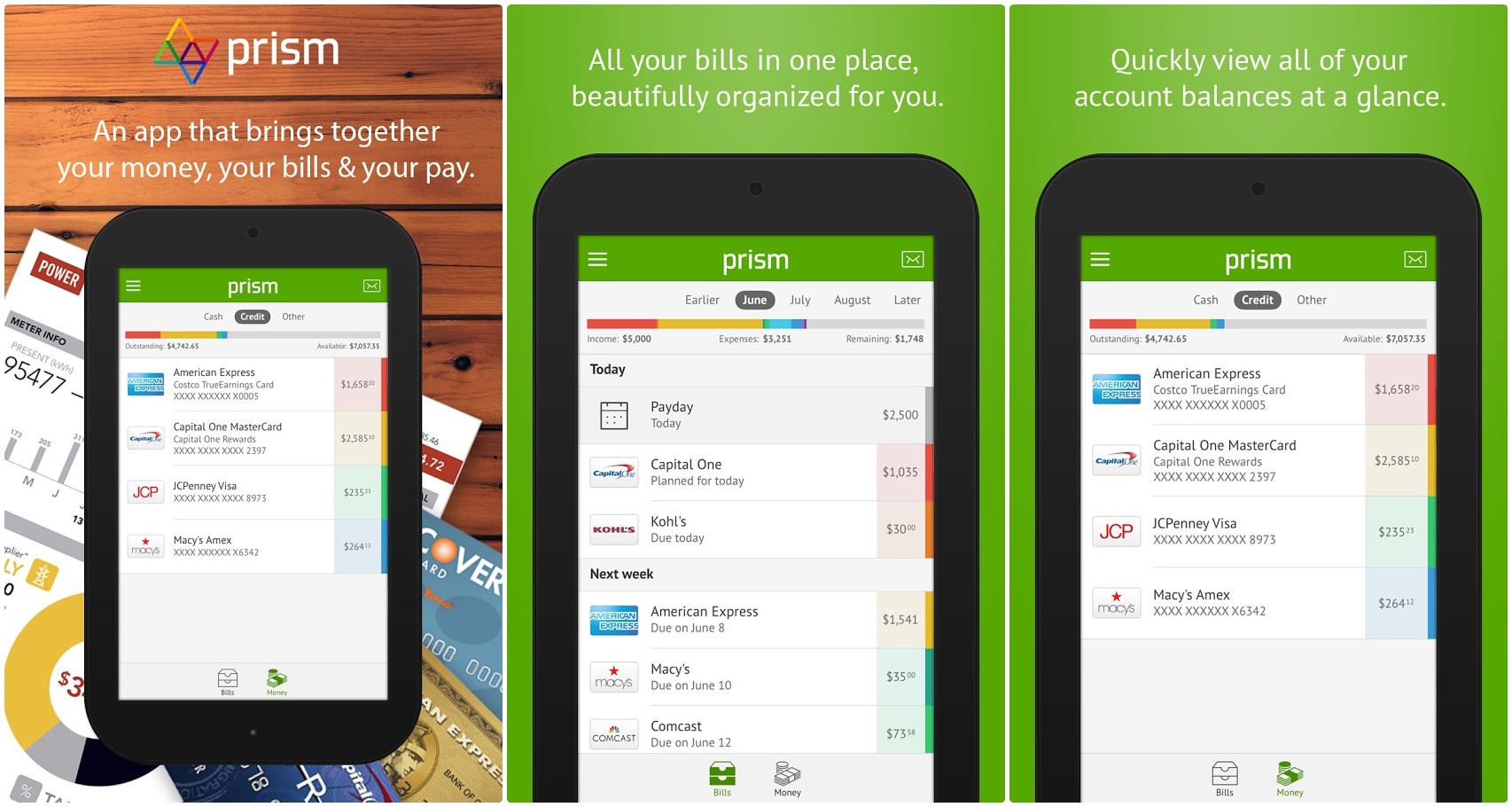

Prism – best for paying bills

Prism consolidates all of your bills and financial statements into a single app, providing you with a full financial view. Larger banks and much smaller utilities providers are among the app’s 11,000 billers, which is greater than any other app. When you add your bills, Prism keeps track of them and sends due date updates to help you stop late payments. You can pay your bills with the app by scheduling transfers on the same day or multiple days in advance.

Personal Capital – most effective for wealth management

Personal Capital is a PF and money management application that lets you track your savings, portfolios, and daily spending accounts all in one place. While you can use the app to monitor expenses and build a monthly budget by connecting it to your bank account, it only shines when it comes to helping you track and maximise your savings. You can also explore options for diversification, risk avoidance, and any secret payments you might be charged with the app’s built-in intelligence, available on both the tablet and smartphone edition of the app. Personal Capital has certified financial planners who will give you personalised advice based on your objectives.

Mobills – has the best visuals

Mobills categorises your costs so you can keep track of how close you are to reaching your budgeted sum. Check how much money you have leftover in each budget segment to see whether you need to cut back. The budgeting app features interactive maps that help you to assess your financial situation and make changes as needed to achieve your broader financial objectives. Link your credit cards to the app to see your total balance and spending limits in one easy spot.

Spendee – most suitable for shared expenses

Spendee lets you build shared wallets for friends and family to keep track of shared spending for a household budget. Import your bank deposits and let the app categorise them for you to keep track of your monthly expenses. You could manually enter cash expenditures to get a more precise view of your spending habits. Create budgeted sums for each spending segment and chart the progress against the budgeted sum to avoid going over budget. The bill tracking feature means that you know to pay all of your bills on time to prevent late fees.

Clarity Money – most useful for managing subscriptions

Subscription-based business models are becoming increasingly popular. It’s easy to lose count of the subscriptions you’ve signed up for in the process. Clarity Money seeks to help you avoid wasting money on expired subscriptions by assisting you in identifying and canceling unused subscriptions. In addition to removing unnecessary subscriptions, the app analyses your spending habits and makes suggestions to help you change your financial situation. Clarity Money helps you to set aside money daily and to tie your investments to a specific target.